Our Blog

Recent:

Decoding the Housing Market: Understanding Home Prices and Mortgage Rates

When you're on the precipice of making a significant decision like buying a home, it's natural to find yourself wading through a sea of information. The latest trends in the housing market become your primary concern, and you begin to gather knowledge from every conceivable source – news, social media, your real estate agent, friends, family, and even overheard snippets of conversation at the supermarket. Two key aspects you'll often find coming up in your research are home prices and mortgage rates.

To effectively navigate this information overload and arrive at the most valuable insights, it's essential to consult reliable data sources and ask yourself the right questions. So, here are the top two questions you need to address regarding home prices and mortgage rates when considering a home purchase:

1. What's the Future Trajectory of Home Prices?

To answer this, you can rely on credible sources such as the Home Price Expectation Survey (HPES) from Pulsenomics. This survey aggregates views from a national panel comprising over a hundred economists, real estate experts, investment gurus, and market strategists.

According to the most recent findings, the experts surveyed predict a minor depreciation for this year. However, it's important to note that significant price drops are already in the rearview mirror, and prices are climbing once again in many markets. The slight 0.37% depreciation projected by the HPES for 2023 is a far cry from the major downturn that some anticipated.

Looking ahead, the forecast indicates a positive shift in home prices from 2024 and beyond. The experts expect home prices to appreciate, reverting to a more standard growth pattern for the next few years.

So, why is this significant for you as a prospective homebuyer? It implies that if you purchase a home now, you can expect your property to appreciate in value, resulting in an increase in home equity over time. If you wait, these forecasts suggest that you'll end up paying more as home prices continue to rise.

2. How Will Mortgage Rates Change in the Future?

Mortgage rates have seen an upward trend over the past year, influenced by factors such as economic uncertainty and inflation. However, recent reports indicate a slight easing off from the peak of inflation, which bodes well for the market and mortgage rates.

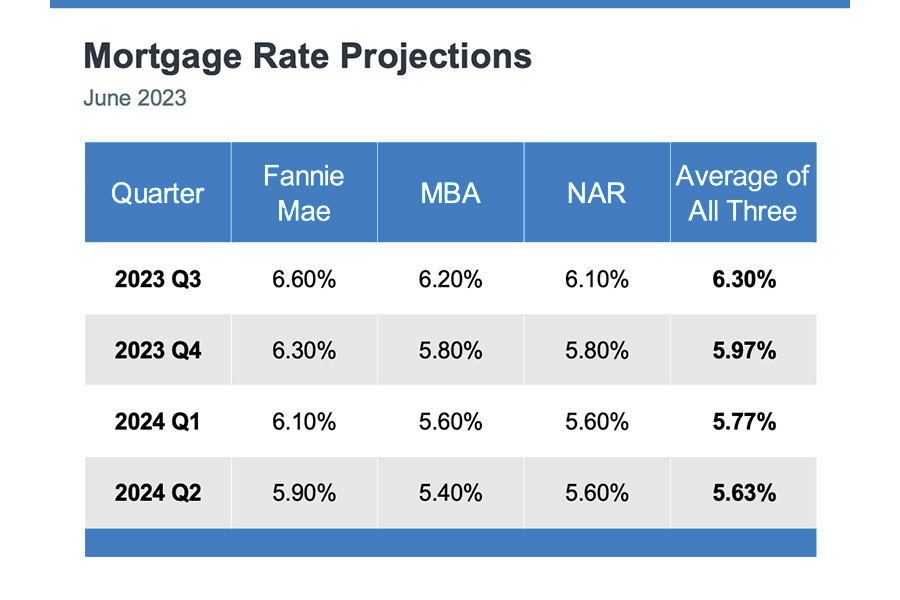

The logic here is straightforward: as inflation slows, mortgage rates tend to decrease correspondingly. Thus, some experts are projecting a modest pullback in mortgage rates over the forthcoming quarters, stabilizing between approximately 5.5% and 6%.

That being said, predicting future mortgage rates with total certainty is practically impossible due to the multitude of influencing factors. So, here's what you should contemplate:

- If you buy now and mortgage rates remain constant, you've made a wise move. As home prices are projected to rise, securing your home at the current price is a win.

- If you buy now and mortgage rates drop (as anticipated), you've likely made a sound decision. You've bought your home before further price appreciation, and you could potentially refinance later if rates are lower.

- If you buy now and mortgage rates increase, you've made an excellent choice. You've purchased before the home price and the mortgage rate escalated.

Deciphering the Market Trends: The Bottom Line

If you're contemplating buying a home, understanding the trajectory of home prices and mortgage rates is critical. Although absolute certainties are elusive, expert projections can offer valuable insights to keep you informed.

Buying a home is a significant milestone and requires careful consideration. As a prospective buyer, you deserve expert guidance to help you understand the dynamics of the local market and make an informed decision. Connecting with a seasoned real estate professional can provide you with valuable insights, helping you turn your dream of homeownership into a reality.

7-12-2023

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans