Two Reasons Why the Housing Market Isn’t Headed for a Crash

Lately, there's been buzz about the economy and the possibility of a recession, leading some to worry about a potential housing market crash. If you're feeling concerned, take a deep breath—there’s no reason to panic. The current housing market is structured very differently than it was in 2008.

Real estate expert Michele Lerner explains:

“A housing market crash typically occurs when home values drop due to a combination of oversupply and weak demand.”

With that in mind, here are two key reasons why a housing market crash isn’t on the horizon.

1. Housing Demand Continues to Outpace Supply

Back in 2008, one of the major contributors to the housing crash was an overabundance of homes. Today, however, the situation has reversed.

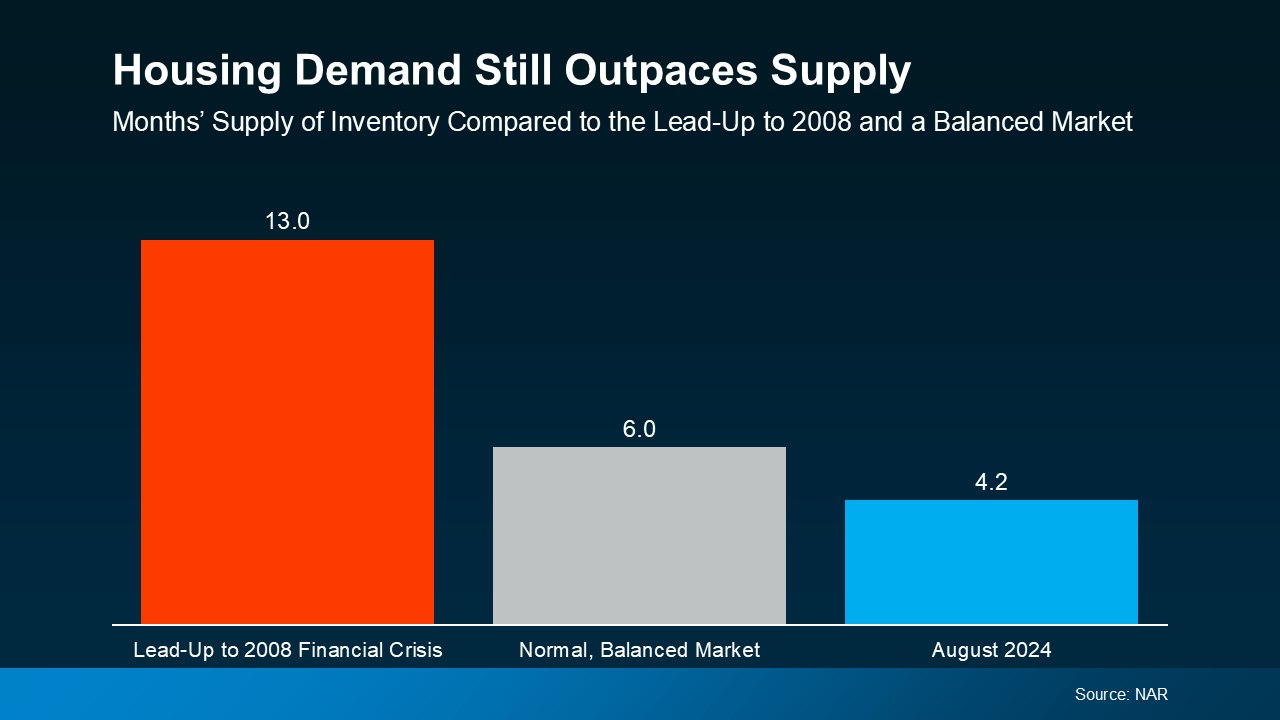

In a balanced market, the supply of homes typically lasts about six months. If the supply surpasses that, it means there are more homes available than buyers, leading to a decrease in prices. Conversely, if supply is lower, demand exceeds availability, which helps maintain or raise home prices. (See graph below):

Currently, there is only about a 4.2-month supply of homes, according to the National Association of Realtors (NAR). Compare that to the 13-month supply before the 2008 crash, and it's clear the dynamics are very different now. With more buyers than homes available, prices are more likely to hold steady or increase, making a market crash unlikely.

It’s important to note that inventory varies across different regions. While some areas may experience more balance or slight oversupply, the majority of markets are facing housing shortages.

Lawrence Yun, Chief Economist at NAR, explains:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

2. Low Unemployment Supports Home Stability

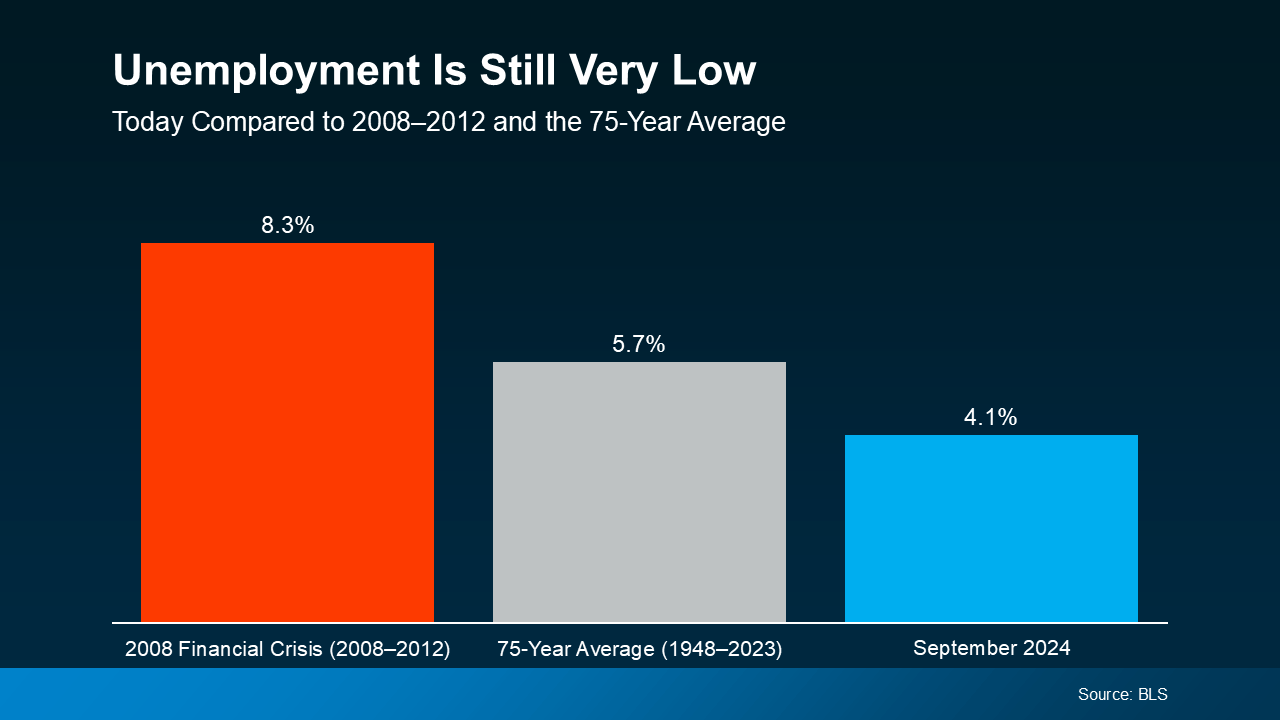

Unemployment plays a crucial role in the housing market. When unemployment is high, people struggle to pay their mortgages, which can lead to foreclosures and forced sales. This was a significant factor during the 2008 crisis. (See graph below):

Today’s employment situation is much more stable. The current unemployment rate is around 4.1%, significantly lower than the 8.3% seen during the 2008 financial crisis. As more people remain employed and financially stable, they are better able to meet their mortgage obligations, reducing the likelihood of foreclosures.

Additionally, with a large portion of the population employed, many individuals are in a strong position to purchase homes, which keeps demand—and prices—strong.

The Housing Market Is More Resilient Now Than in 2008

While economic uncertainty and talks of recession can be worrisome, it’s essential to recognize that today’s housing market is much healthier than it was in 2008. As Rick Sharga, Founder and CEO at CJ Patrick Company, says:

“Today’s housing market dynamics are entirely different from the conditions that led to the housing crisis.”

The imbalance between supply and demand, coupled with low unemployment rates, will continue to support the housing market and prevent a crash from occurring.

Bottom Line

Although the housing market is in a stronger position than it was in 2008, it’s always wise to stay informed about local market conditions. If you have any questions about what’s happening in our area or want to explore the current trends, don’t hesitate to reach out!

Categories

Recent Posts