The Unexpected Equity You've Accumulated Over the Years

There are many reasons why selling your home might be on your mind. As you weigh the possibilities, one challenge you might be facing is the current market’s affordability. If that’s a concern, taking a closer look at how much equity you’ve built in your home could make your decision clearer. Here are two main factors that play a significant role in your home equity growth:

How Long You've Owned Your Home

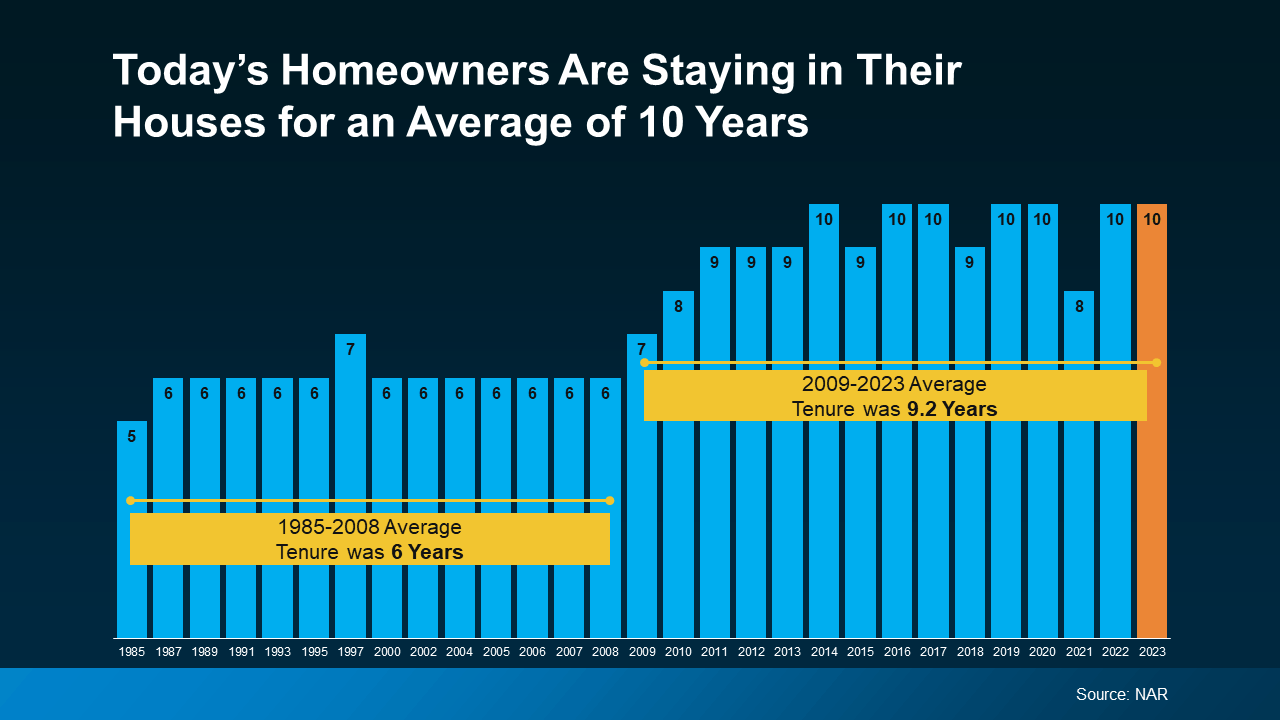

The length of time you’ve owned your property—also known as homeowner tenure—directly impacts your equity. Historically, from 1985 to 2009, the average homeowner stayed in their home for about six years before moving. However, more recent data from the National Association of Realtors (NAR) shows that number has risen, with the average tenure now being around 10 years. (see graph below):

Why is this important? Over time, you build equity as you make mortgage payments and as your home increases in value. The longer you’ve stayed in your house, the more equity you’ve likely built, thanks to these two factors combined.

Home Price Appreciation Over the Years

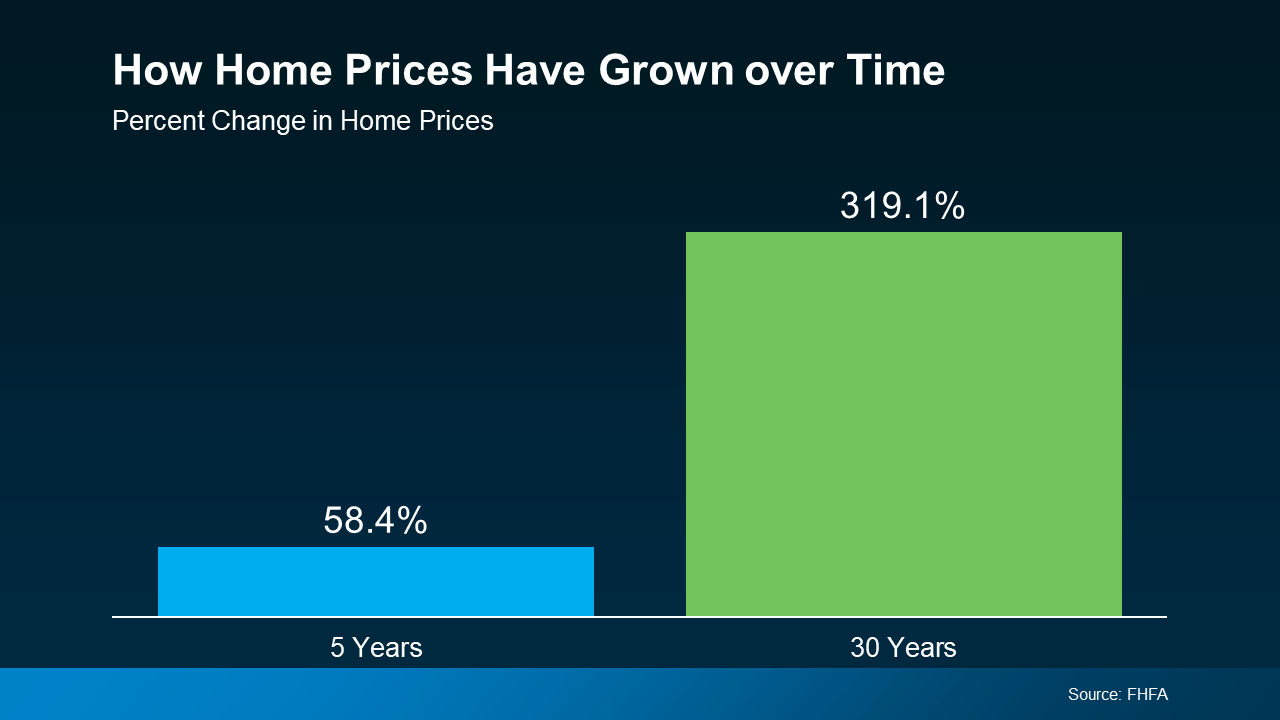

Home prices have appreciated significantly over time, which also contributes to your equity growth. According to the Federal Housing Finance Agency (FHFA), homeowners who’ve stayed in their homes for five years have seen an average price increase of nearly 60%. Those who’ve held onto their homes for 30 years have seen their home values more than triple (see graph below):

This appreciation can make a big difference when deciding to sell your home. Whether you’re downsizing, moving closer to loved ones, or simply ready for a change, the equity you’ve built can be a valuable asset for your next move.

Bottom Line

If you’re curious about how much equity you’ve built up over the years and how it could help you with your next home purchase, reach out today. Let's explore your options together.

Categories

Recent Posts