Renting vs. Buying: The Net Worth Gap That May Surprise You

Deciding between renting or buying a home? One significant factor that could help guide your decision is the impact homeownership can have on your net worth.

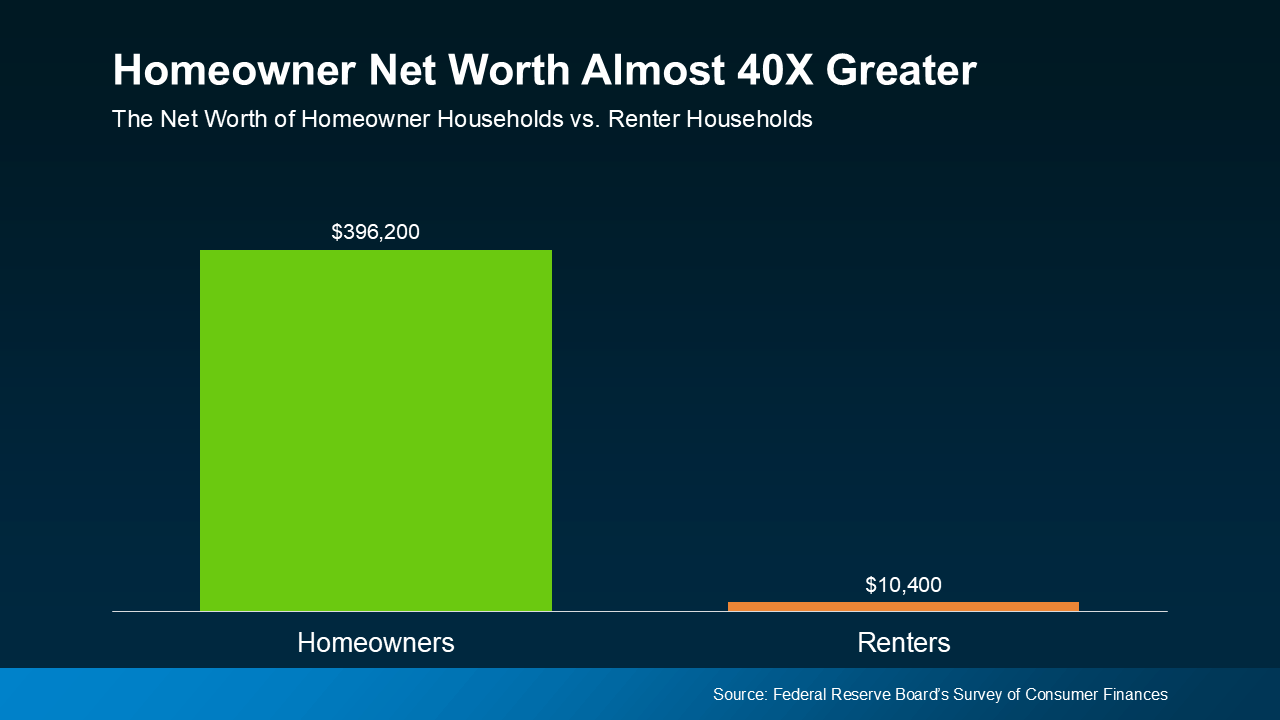

Every three years, the Federal Reserve Board publishes the Survey of Consumer Finances (SCF), which sheds light on the wealth gap between homeowners and renters – and the difference is substantial.

According to recent data, a homeowner’s net worth is, on average, nearly 40 times greater than that of a renter. Take a look at the numbers to see this contrast:

Why Homeowner Wealth Outpaces Renting

In a past SCF report, the typical homeowner’s net worth was approximately $255,000, while the average renter’s was around $6,300. This was already a large disparity, but in the most recent survey, the gap widened further as homeownership wealth increased (see updated graph below).

The SCF noted that:

“. . . the 2019-2022 growth in median net worth was the largest three-year increase over the history of the modern SCF, more than double the next-largest one on record.”

One major reason for this increase is home equity.

Home equity represents the difference between a home’s market value and the outstanding mortgage balance. As you pay down your mortgage, or as your property appreciates, your equity grows. Over recent years, home prices have risen due to limited supply and high demand, translating into greater home equity and net worth for owners.

Should You Rent or Buy?

If you’re weighing the decision between renting and buying, here’s something to keep in mind: While inventory has improved in 2024, demand still generally outstrips supply. As a result, experts predict moderate price appreciation in the coming year, which could mean additional equity gains for buyers who act now.

This isn’t the unprecedented appreciation seen during the pandemic, but it does point to steady value growth for those looking to build wealth. Economist Ksenia Potapov from First American emphasizes:

“Despite the risk of volatility in the housing market, homeownership remains an important driver of wealth accumulation and the largest source of total wealth among most households.”

Of course, price trends and availability vary by area, which is why consulting a local real estate expert is key. They can share valuable insights about your specific market and help you understand both the financial and lifestyle benefits of homeownership. As Bankrate advises:

“Deciding between renting and buying a home isn’t just about cost — the decision also involves long-term financial strategies and personal circumstances. If you’re on the fence, speaking with a knowledgeable local real estate agent can help you weigh your options and make a more informed decision.”

Bottom Line

If you’re uncertain about whether renting or buying is right for you, remember that homeownership could significantly increase your net worth over time. And if affordability is a concern, let’s discuss available programs that might bring homeownership within reach.

Categories

Recent Posts