How Mortgage Rate Changes Impact Your Homebuying Power

If you're considering buying or selling a home, mortgage rates are probably top of mind. That's because mortgage rates directly impact how much house you can afford and how much you'll be paying in your monthly mortgage payment. Let's break down what you need to know about mortgage rates and how they affect your homebuying power.

What’s Happening with Mortgage Rates?

Mortgage rates have recently shown signs of easing. While this can be positive news for potential homebuyers, it's crucial to remember that rates are influenced by several factors and can be unpredictable.

Elements such as the broader economy, job market stability, inflation trends, and decisions from the Federal Reserve all influence rates. Even with a decline in rates, they can still fluctuate depending on economic data. As Odeta Kushi, Deputy Chief Economist at First American, explains:

"The ongoing deceleration in inflation, coupled with the Federal Reserve’s recent indication of potential rate cuts [in 2024], suggests an environment supportive of modest declines in mortgage rates. Barring any unforeseen circumstances and resurgence in inflation, lower mortgage rates could be on the horizon, but the journey towards them might be slow and bumpy."

How Do These Changes Affect You?

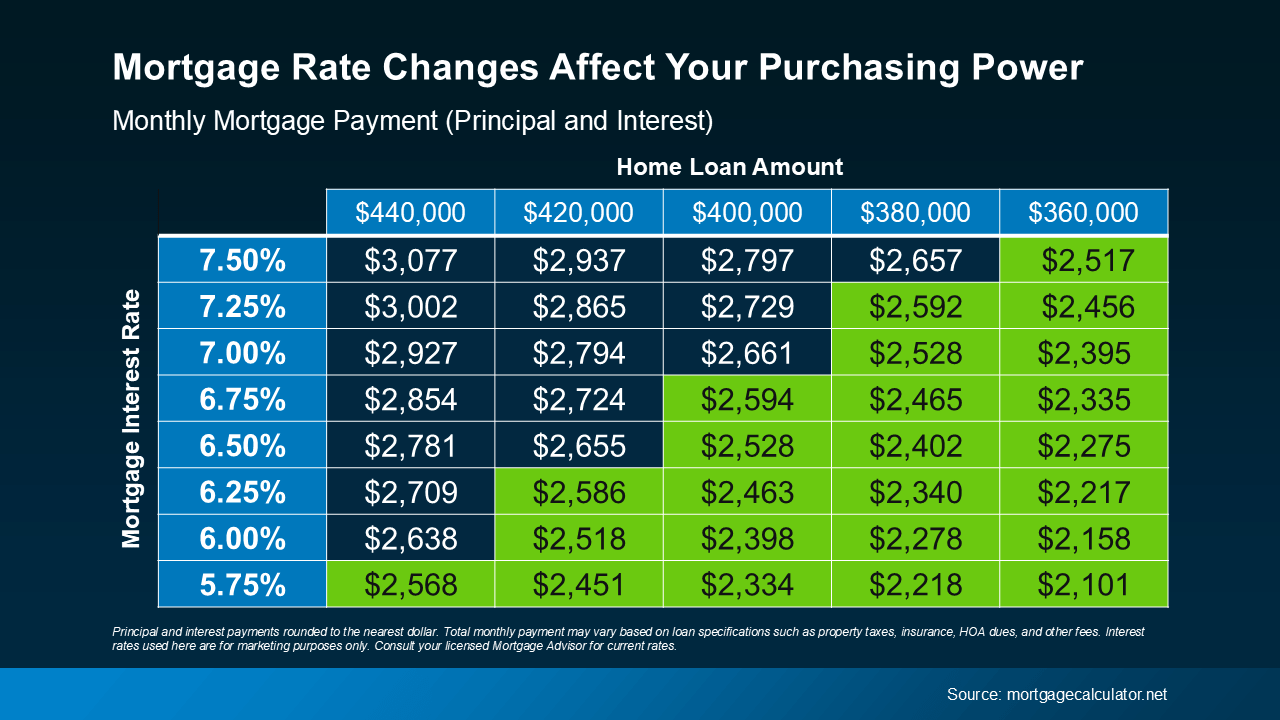

Changes in mortgage rates can significantly impact your monthly mortgage payment. Even a small adjustment in the rate can shift your overall costs.

For example, if you’re budgeting to afford a $2,600 monthly payment for a mortgage, a shift in rates could increase or decrease the size of the loan you can secure within that payment range. The green part in the chart shows payments in that range or lower based on varying mortgage rates (see chart below):

Understanding these shifts allows you to make more informed decisions when planning your home purchase.

Understanding these shifts allows you to make more informed decisions when planning your home purchase.

Staying Updated on Mortgage Rates

You don’t need to be an expert on mortgage rates, but staying informed can help. Real estate professionals can provide you with current insights, tools, and resources, such as charts and calculators, to illustrate how rate changes impact your buying power.

Having a knowledgeable agent by your side means you’ll have someone to interpret the market data and guide you through your homebuying or selling process with confidence.

Bottom Line

Whether you’re actively searching for a home or just exploring your options, staying informed about mortgage rates is key. If you have questions about how rate changes might affect your homebuying journey, let’s connect. Having the right information will empower you to navigate the market with greater confidence.

Categories

Recent Posts