One of the greatest financial benefits of homeownership is building equity in your property. Today, homeowners across the country are enjoying record-high equity levels, and this wealth can transform your next move.

Here’s how home equity can be a game changer and why it might shift your mindset from “Why would I move now?” to “Why wouldn’t I?”

What Is Home Equity?

Home equity is the difference between your home’s current market value and the amount you owe on your mortgage. For instance, if your house is worth $400,000 and your remaining mortgage balance is $200,000, you have $200,000 in equity.

Why Home Equity Matters When Selling Your Home

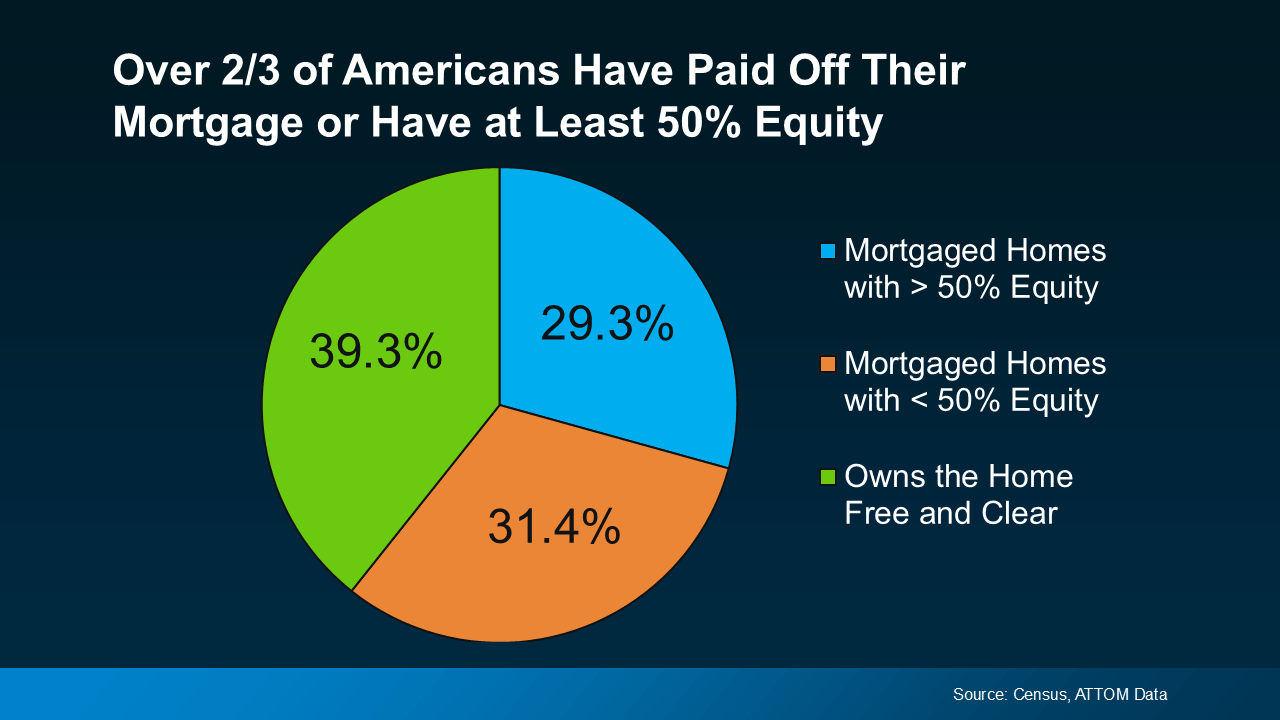

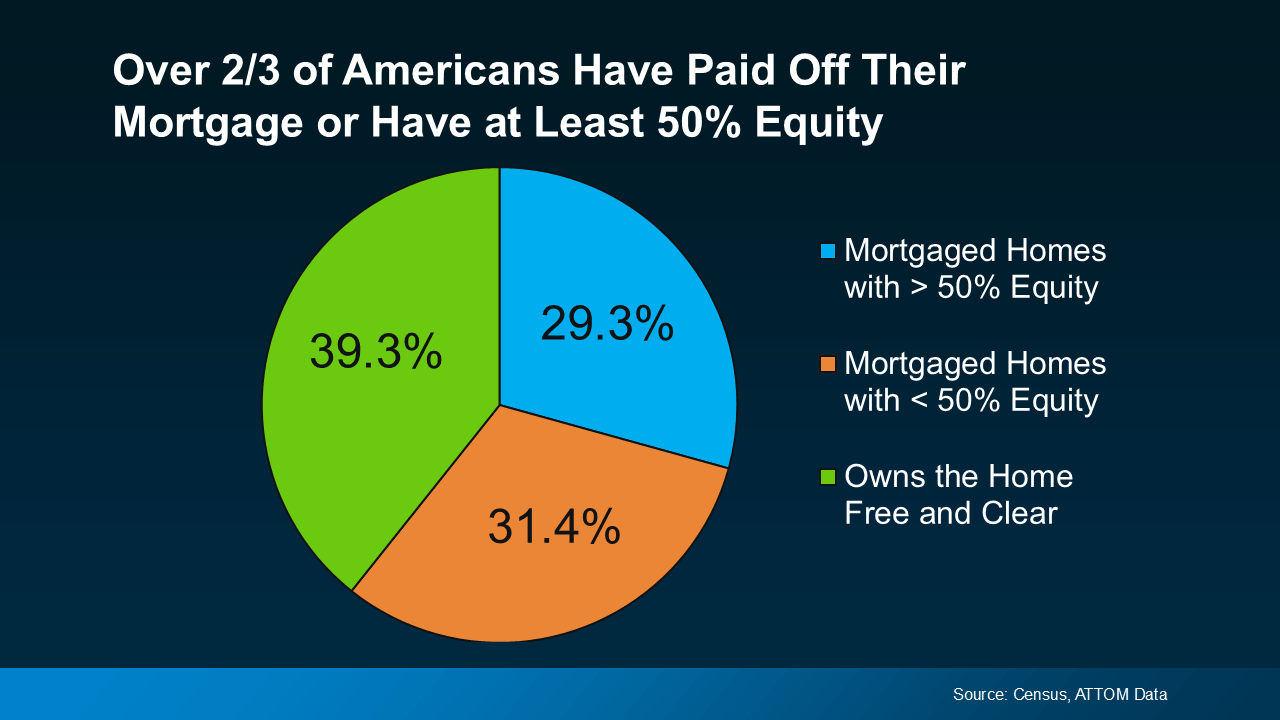

Recent studies highlight just how substantial today’s home equity is. According to data from the Census Bureau and ATTOM, more than two-thirds of homeowners have either fully paid off their mortgages or hold at least 50% equity in their homes. (shown in blue in the chart below):

This is significant because it means many homeowners are sitting on considerable wealth. For example, CoreLogic reports that the average homeowner has approximately $311,000 in equity. That amount could open doors to new opportunities, such as purchasing your next home without a mortgage.

The Rise of All-Cash Buyers

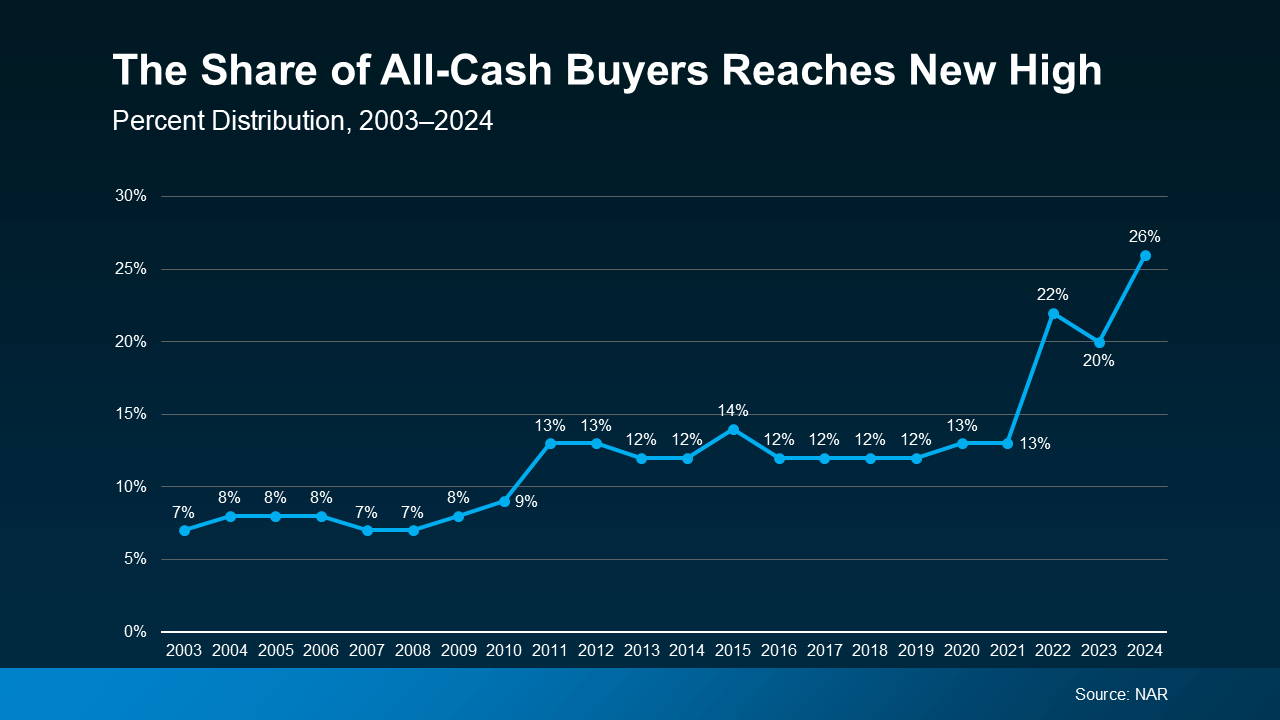

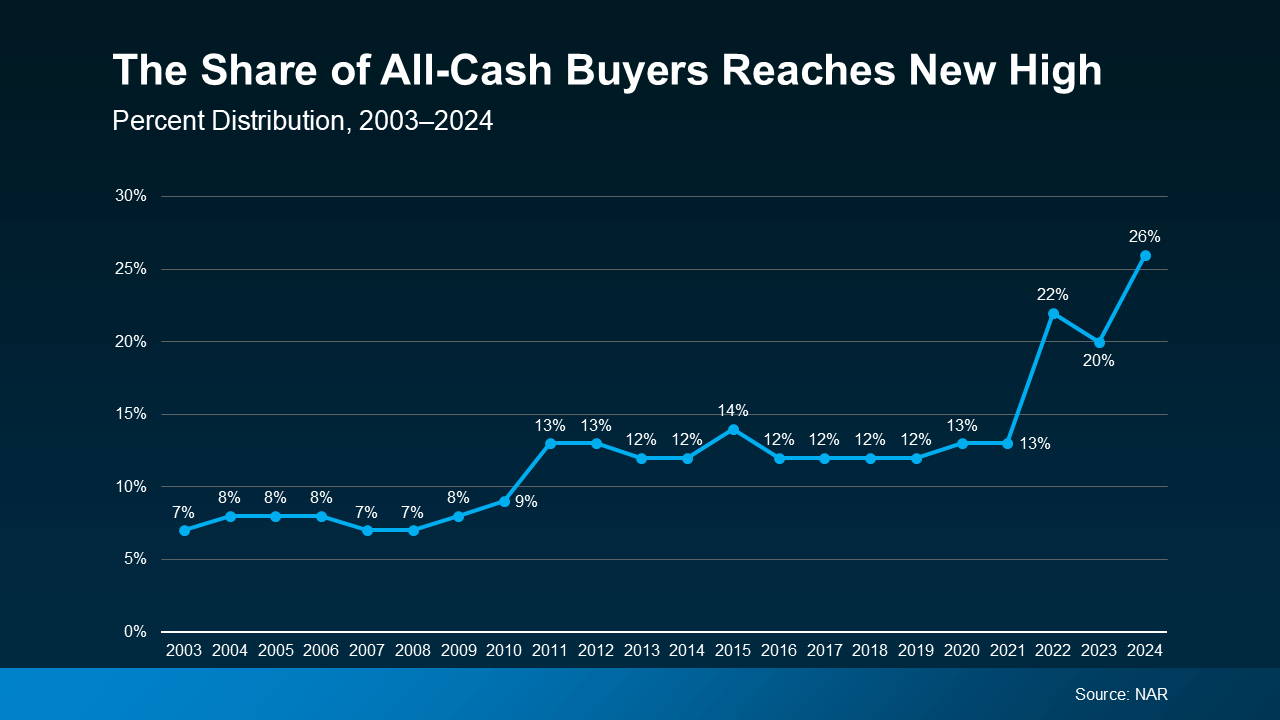

High levels of home equity have contributed to an increase in all-cash buyers. According to the National Association of Realtors (NAR), 26% of homebuyers recently purchased their homes outright, without financing. (see graph below):

Imagine using your equity to buy your next home in cash. That means no mortgage payments, no interest rates, and no financial stress tied to a home loan. Even if your equity doesn’t cover the entire cost, it can significantly boost your down payment, reducing your loan amount and monthly payments.

Find Out How Much Equity You Have

The first step to leveraging your equity is understanding how much you have. A professional equity assessment report (PEAR) from a real estate agent can provide a clear picture of your current equity. This information can help you decide how best to use it, whether that’s buying a home outright or making a substantial down payment.

Bottom Line

With homeowners experiencing record equity levels, now could be the perfect time to make a move. Whether you’re considering buying your next home in cash or simply reducing your mortgage, your equity holds the key to your next step. Let’s connect to explore your options and make the most of your home equity.